Rise of OTT and CTV

During the early days of the pandemic, with not much to do and certainly nowhere to go, we were all hooked on to either rewatching some of our favourite TV shows or finally being able to catch-up on all the content we added to our must-watch list. The pandemic accelerated growth of OTT consumption and CTV adoption, primarily in APAC, is simply undeniable. GroupM’s “This Year Next Year” research found that OTT Investment in APAC is expected to grow from US$4.3 billion to US$7.2 billion between 2020 and 2026, which is approximately a 67% increase in six years.

There are several factors that have contributed to the OTT wave, but the ones that have made their popularity stick are:

- The penetration of smartphones (particularly true for markets like India and Indonesia)

- Bundling of SVOD services with telecom providers across the region

- Emergence of locally relevant and quality content.

OTT players had heavily invested in creating original content that would be locally relevant for different markets. Playing the hyper-local game is not only paying dividends to giants like Netflix, Disney+, Amazon but also to local players like Tencent, Viu, iQIYI. APAC has the largest and fastest growing SVoD subscription base in the world and is expected to grow over 40% of the global SVoD base. The growth of OTT subscription across APAC markets as complementary effect – rise in CTV purchases. India is one of the fastest growing CTV markets within APAC.

Opportunities and Advantages for Brands

As viewers continue to shift away from traditional television towards digital streaming platforms, brands are presented with a wealth of opportunities to engage with their target audiences in innovative and personalised ways.

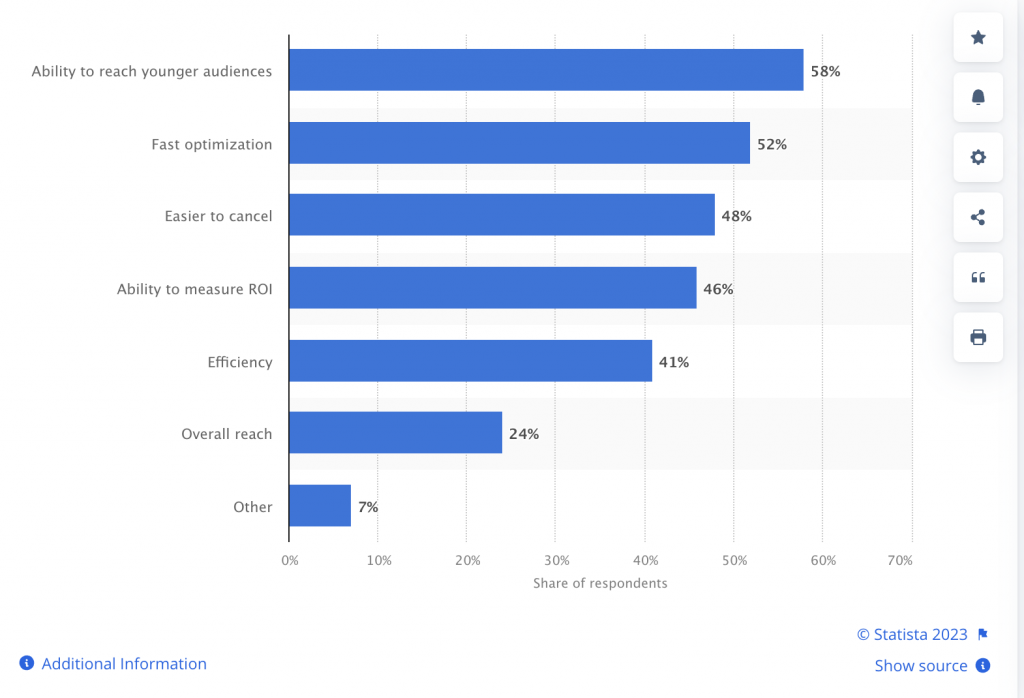

According to Insider Intelligence the US CTV ad spend, which hit $26.92 billion in 2023, is continuing its double digit growth since 2017. While APAC is yet to see similar growth in ad spends for CTV, advertisers are beginning to see the advantages CTV advertising presents compared to traditional TV advertising.

One of the major attractions is that CTV seems to have won over GenZ and younger audiences. In SEA, Gen Zs or young Millennials (16–34) make up 44% of OTT watchers.

A study in 2019 showed that there is real appetite for ads on OTT platforms (in SEA) if it means people can watch content for free or lower prices. Almost 89% of viewers are ready to watch two or more ads in exchange for 1 hour of free content. This can certainly pave the way for AVOD models to work well within the region, and players like HBO, Netflix and Disney+ are extensively looking into making this available for APAC markets.

CTV allows advertisers to test, learn and discover new audiences at a fraction of the cost of traditional TV. And so, advertisers in APAC are currently exploring and experimenting how CTV can be part of their omni-channel strategy to reach and engage a wide spectrum of audience.

Challenges and Future of CTV and OTT

In markets like EMEA and Americas, advertisers are beginning to see the how the CTV audiences can help them achieve their business goals. Check out how dentsu’s Carat collaborated with Quantcast to get 2x audience engagement for Pandora. However, some challenges still linger as brands embrace CTV for advertising. Buying ad inventory for CTV is still very fragmented. Three of the largest CTV platforms Amazon, Roku, Samsung operate their own DSPs. A dynamic CTV marketplace must be introduced to replace inefficient inventory reserves, increase transparency, and drive transaction costs down for marketers.

Additionally, measurement is another major concern for advertisers. Much like the early days of video, the measurement approach for CTV is largely dependent on impression delivery rather than brand awareness or conversion lift. Impression delivery doesn’t give advertisers the whole picture and doesn’t fully explain viewability and video completion rate. As CTV becomes more prominent advertisers will demand standardization of video ad metrics across CTV channels so that they can analyse the ad effectiveness of the channel more accurately.

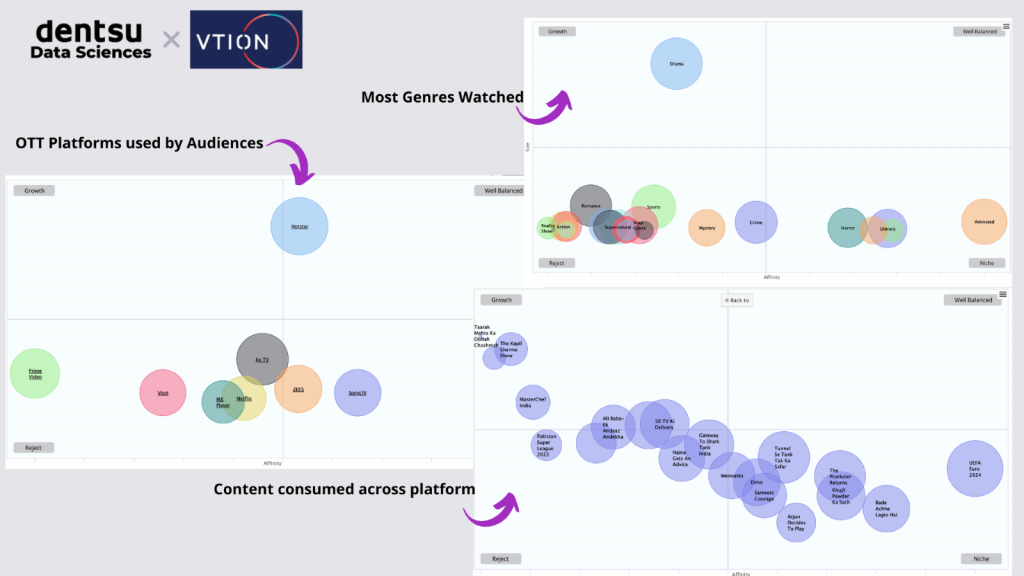

As the CTV industry evolves, we are certain that these challenges will be addressed along the way. In India, DMC is helping brands understand which OTT platforms their audiences use the most and additionally what content are they consuming. In collaboration with VTION, we are able to help brands not only with these critical insights but also make it easier for them to plan a campaign around these audiences.

The CTV advertising arena is set to see some major shifts in 2023. The integration of OpenRTB 2.6, the latest update to the IAB Tech Lab’s standard protocol, which creates a simplified process for buying and selling inventory CTV through ad podding similar to linear TV. With the deprecation of 3P cookies, contextual targeting is increasingly becoming an option for advertisers. For this, CTV might present the perfect ad opportunity as the channel enables cookieless audience targeting in a way that aligns with different brands.